If you’ve never handled a totaled car through an insurance claim before, you might not know what to expect. What does the insurance company pay? How do they calculate the value of your car?

Most of your questions can be answered by the total loss valuation report. This is a document that breaks down exactly how your vehicle has been valued. It’s long, it’s detailed, and it can be overwhelming.

That’s why I’m here for you. To break down the breakdown. I obtained a copy of an actual total loss evaluation, courtesy of my friend Tyler and his wrecked Camaro. I’ve redacted the personal details, of course, but I’ll explain it in pieces.

Here’s my step by step guide to reading the total loss report.

How a vehicle gets totaled

Before the auto insurance company runs a valuation report, they need to determine if a damaged vehicle is a total loss.

First, your car insurance company will determine the cost of repairs. A vehicle damage adjuster will assess how much damage there is, and write an estimate of repair costs. Depending on the situation, this could be a fully detailed estimate, or a quick list of major repair costs.

Many companies will look at total loss indicators to save time: rollovers, airbags deployed, fire, frame damage, high mileage, and older cars all mean a good chance of a total loss. One or more of these items, and the adjuster might skip writing the repair estimate and go straight to a total loss claim.

If a vehicle costs more to fix than it is worth, it is a total loss.

Insurance companies are guided by state regulations. Some states require use of a specific total loss formula. This specifies a vehicle as a total loss once the estimated cost of repair tops a percentage of the car’s value (called the total loss threshold). If state law doesn’t set a formula, then companies typically consider the vehicle’s value minus the salvage value (they are usually able to recoup some of the cost by selling the scrap vehicle to a salvage yard).

Insurance owes the vehicle’s actual cash value.

The actual cash value, or ACV, is not what you paid for the car. It’s not the cost of a replacement vehicle. And it’s not the Kelley Blue Book value. The ACV is the fair market value, based on other similar vehicles recently sold in the local area. It is the pre-accident value, what your vehicle would have sold for just before the loss.

Car insurance companies do not track these values themselves. They use a third party service to get a neutral, unbiased report. In cases of common cars, there are usual many comparable vehicles to analyze. With rare or older vehicles, there are often less comparable vehicles (comps) available, which sometimes necessitates looking in a wider area.

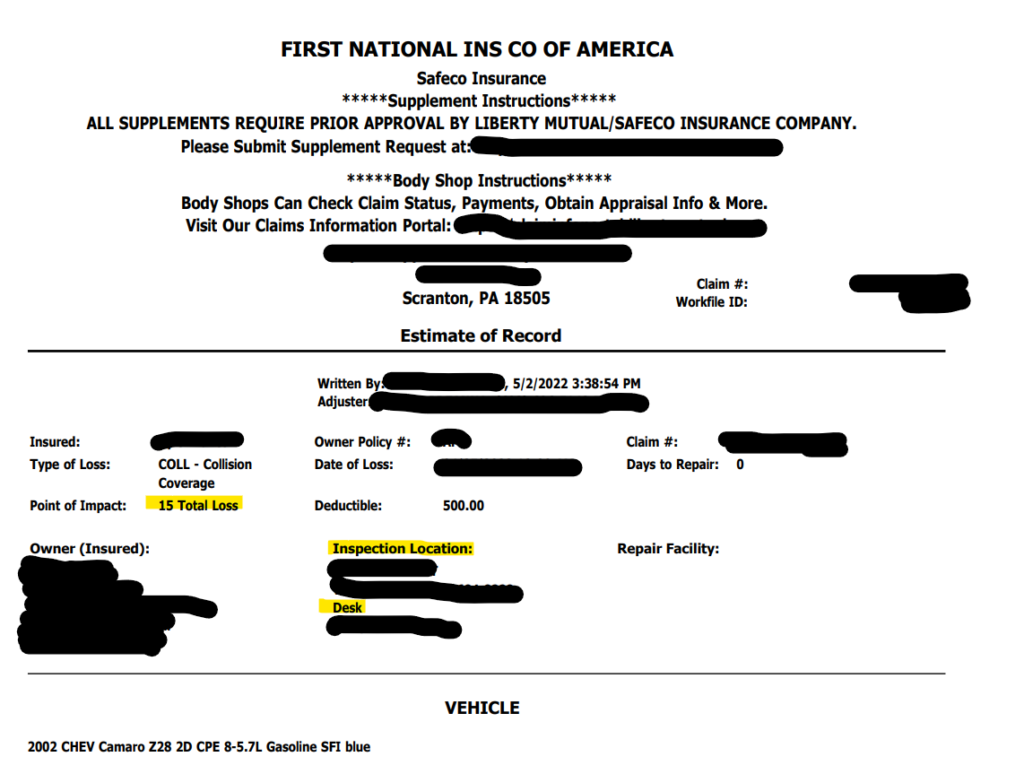

The Repair Estimate

In the case of Tyler’s Camaro, the insurance adjuster wrote a quick estimate based on photos of the vehicle. “Inspection location: desk” means the adjuster did not physically go to the body shop or salvage yard. “Point of impact: total loss” means the adjuster was already figuring the car was totaled. They were writing the estimate to show their work – proving that the cost of the repairs would be high.

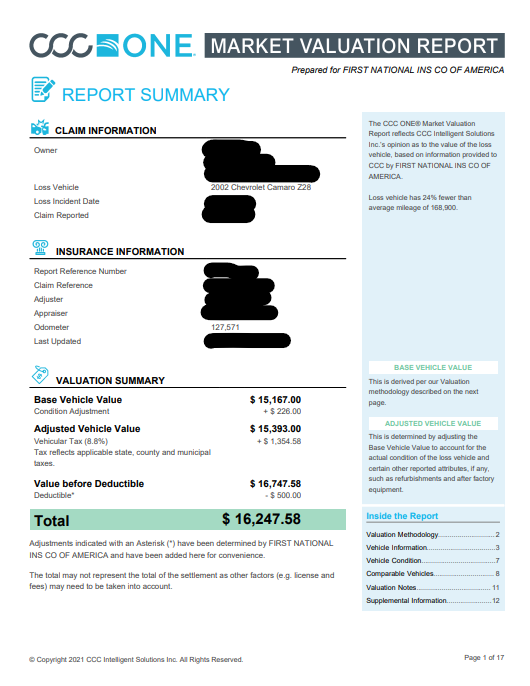

The Value Report – Page One

The first page is the valuation summary. This lists all the important information at a glance – the claim info, vehicle identification, and the car’s value.

The base vehicle value is what the calculations come out to based on the comparable vehicles. Directly under that is a condition adjustment. In this case, the adjuster thought Tyler’s Camaro was in overall better condition than similar vehicles with similar mileage. The details of the condition are listed later in the report.

The adjusted vehicle value is just that: the value after any additions or subtractions by the adjuster. Next the report lists any other items payable to the owner based on state laws. In this case, they added sales tax.

Finally, the report subtracts the deductible. Since Tyler’s car was covered by his own collision coverage, the deductible is taken off the value. If this was a liability claim being paid by an at-fault party, there would be no deductible.

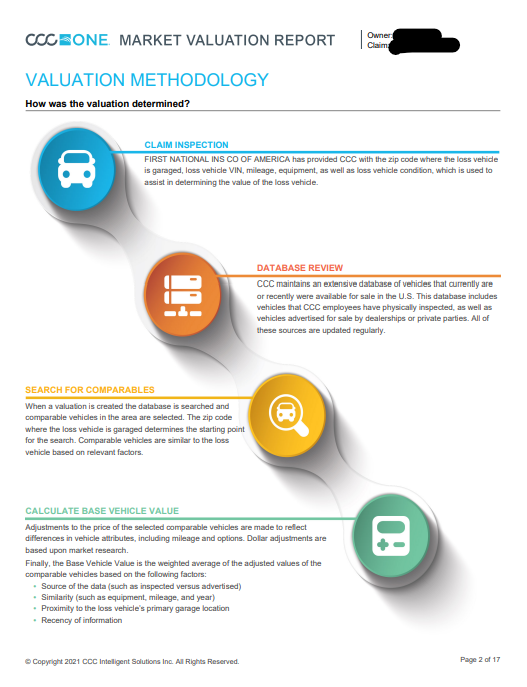

Page Two – Methodology

This valuation report was prepared by CCC, a popular company within the insurance industry. The second page explains their process for valuing vehicles.

First, they specify that the insurance company is the one that provides all information about the totaled vehicle. If there are any mistakes with the input information, you need to address that with the adjuster.

Second, CCC explains that they keep a database of vehicle sales. Data is their business, and they track a lot of it.

Third, they specify that the search is done geographically, starting with your home zip code. So a vehicle that sold in your city is much more likely to show up on the report than a vehicle in a different state.

Fourth, they explain how comparable values are calculated, and how each different factor or option adds or subtracts value. Again, this is based on their data. Each comp is then weighted based on several factors to calculate the totaled vehicle’s ACV.

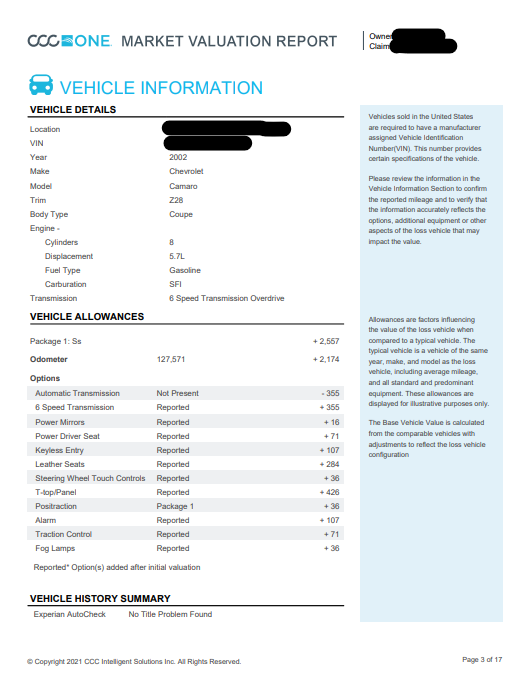

Page 3 – Vehicle Information

On the third page, the report starts detailing the vehicle information. The top of the page starts with the basics. The second half lists every option on the vehicle, including the dollar amount each option adds.

If you are wanting to check the accuracy of your total loss report, this is where you start. Make sure the VIN is correct and all packages are listed. Make sure every option is listed (in this case the SS package added $2557 to the value). And make sure the mileage is correct. Mileage makes a huge difference in the car’s value (this mileage on a 20-year-old car added $2174).

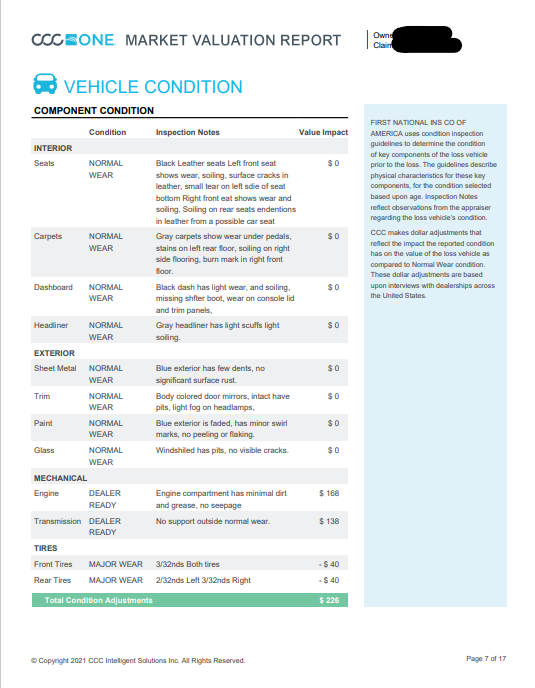

Page 7 – Vehicle Condition

The next section rates the condition of various parts of the vehicle. This rating is done by the insurance adjuster who inspected the vehicle. They will note any major damage, such as unrepaired prior losses. They will note if the engine is leaking or the seats are ripped. They will also note if anything is in better than average condition. In Tyler’s case, his engine compartment was spic and span. The adjuster rated engine and transmission as dealer ready, adding several hundred dollars to the value.

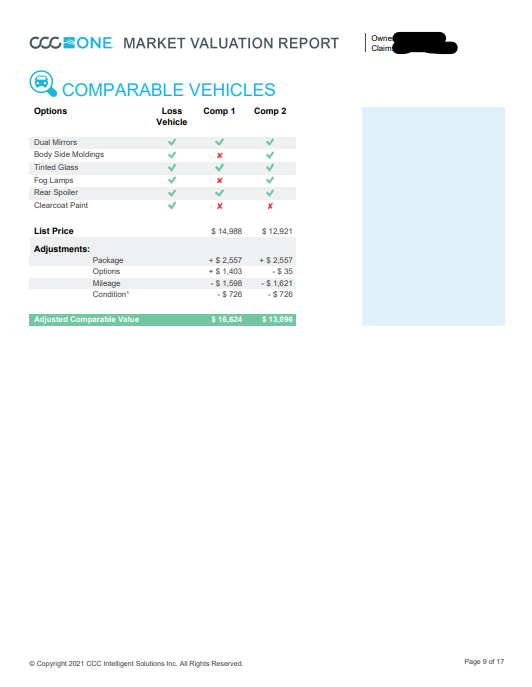

Page 8 – Comparable Vehicles

This is where the report shows exactly what vehicles they looked at to assess the vehicle’s value. Since this Camaro was an older specialty car, there were not many comparable cars close by.

There are only two comparable vehicles listed on the report. Both have much lower mileage, but neither have the SS package. The main columns list all the options on the comp vehicles. Off to the right is the details of each comp vehicle, such as VIN and location.

At the bottom of this section is the adjustments. Each column shows the price of the comp vehicle, the adjustments made, and what the value of the loss vehicle would be based only on that one comp. Different vehicles from different sellers will end up with different prices, so there is a variety of potential values.

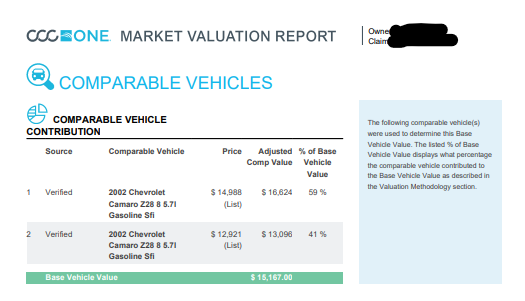

Page 10 – Contribution

This is where the different comparable values are synthesized into a single dollar value. Each comp vehicle is assigned a percentage which weights the final value. According to CCC One’s methodology page, the vehicles are weighted according to source, similarity, proximity, and recency.

In this example, comp vehicle 1 is weighted 59%, and comp vehicle 2 is weighted 41%. The first vehicle is analyzed to be a reliable source of information, more similar in details, closer, and/or a more recent example of price. The comp values are then calculated with the weighted average to reach the final number.

Page 12 – Vehicle Information

This starts a section of supplemental information about the loss vehicle. The first section is an ISO report. The ISO (Insurance Services Office) report is a claim history, listing previous insurance claims on the same vehicle.

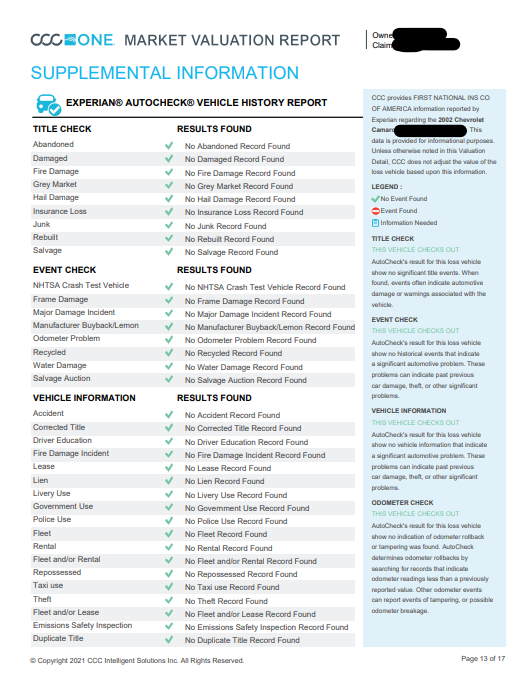

Page 13 – Experian Autocheck

The next section is the Experian Autocheck, which searches other sources for evidence of previous losses, title issues, and vehicle history involving the totaled vehicle.q2

Page 14 – Full History Report

The final section lists a full title, registration, and service history of the totaled car. Based on the VIN, this report starts with the original vehicle sale and title/registration, and runs for several pages up to the present.

Discussing the Valuation With Your Adjuster

When reviewing a total loss valuation, your first concern should be accuracy. As we’ve seen, any incorrect information could throw the value off completely. Be sure to rear my companion post on 5 Ways to Maximize Your Total Loss Claim.

Make sure you know which claims adjuster you should be talking to. You may need to speak with a total loss specialist to correct any information.

Once you’ve reviewed all the information for accuracy, you can discuss the comparable vehicles. If you feel the comps listed aren’t truly representative of the current market for your car, you can try finding other comps to contribute. But be aware, it can be hard to find vehicles that qualify and haven’t been assessed yet. Also be aware that depending on the source, asking prices may be greatly inflated.

More questions about reading a total loss report? Leave a comment or contact me on social media!

0 Comments