When I was handling property-damage only claims, backing accidents were like breakfast, lunch, and dinner. This is a very common type of accident. The majority result in vehicle damage only, but there can be injuries involved, sometimes quite serious. Remember, cars don’t just hit other cars.

In this post, I’ll explain:

- What rules of the road apply

- Common scenarios for backing accidents, and who is at fault

- How insurance companies handle these accidents

- Tips to avoid being involved

- The safest way to leave a parking space

- What to expect if you’ve been in a backing accident

The General Rule

If you are a backing driver in an accident, you will be at fault.

There are many different factors that figure into liability. And often there is shared fault between multiple drivers. As with any accident, liability is always situational.

Each state will word its traffic statute differently, but they all tend to contain the same idea. In my home state of Oregon, ORS 811.480 reads:

“A person commits the offense of illegal backing if the person backs a vehicle the person is driving when it is not safe to do so or when it causes interference with other traffic upon a highway.”

So if (a) you were backing, and (b) there was an accident, then it was obviously not safe to do so. Therefore, you would be at fault.

The Typical Scenarios

Backing accidents can have a lot of factors involved, but I’ll start by illustrating the most clear and obvious example.

In this case, there is a moving vehicle on a roadway. The green car is established in their lane, and they would have the right of way. The pink car is reversing from their driveway.

The pink car doesn’t see the green car coming. The pink car backs out and hits the side of the green car.

In this case, the pink car would be 100% at fault.

I’ll skip ahead to the next common scenario, a parking lot collision. In this case, the yellow truck and the red truck are both backing from opposite sides of the aisle. Both drivers don’t see the danger. They back out at the same time, and make contact in the middle of the aisle.

In this case, both drivers were backing unsafely. Both took the same negligent action, so they would each be 50% at fault.

Insurance Investigations

When a back-up accident is reported, insurance companies will need to complete a thorough investigation. That means gathering all available evidence. (Read more about who determines fault here).

This starts with driver statements. Driver statements are the most important piece of evidence, because only the driver can describe what they were seeing, hearing, and thinking at the time.

Statements also give direction to the investigation, letting the adjuster know what other evidence is available and needed. If there is a dispute about the facts, the driver statements are what make that clear. Typically these statements are recorded so the adjuster can listen back, analyze, and use them as evidence.

The handling adjuster will need to obtain the names and contact information of all people involved, the police report (if there is one), photos of the damage, photos of the scene, witness information and statements, and of course any video evidence if available.

Disputes

Backing accidents are notorious for producing liability disputes. Drivers don’t want to be at fault, and tend to view their own actions in the most favorable light. They often have trouble seeing things from the other driver’s perspective. This all leads to disputes and unhappy drivers.

Liability adjusters may look at a variety of factors to weigh liability:

- Who had control of the lane? If one car was traveling forward, they would have control of the lane, and usually the right of way.

- Who backed first? If a witness or video can clearly show one vehicle backed out before the other, then liability could fall more on the second car.

- Who took evasive action? Did either driver stop, or try to get out of the way? Did they honk their horn? Any evasive action could be favorable.

- Were there any traffic controls? Did either car have a stop sign, or any other specific direction to follow? In a parking lot, was the aisle one-way or two-way? These may all play a factor.

But with disputes, the hard part is proving your case. Because with claims it’s not always about what happened, it’s about what you can prove.

For example, let’s look at the two trucks again. This time, both drivers say they backed out. But the yellow truck says they saw the red truck at the last second, and they stopped. Then the red truck hit them.

The adjuster’s thought process in support of the yellow truck might look like this: Both vehicles were backing, so start at 50/50. The yellow truck took evasive action, so give them 10% less fault for having one favorable factor. This would result in 60% on the red truck, and 40% on the yellow truck.

However, the adjuster in support of the red truck would have counter-arguments: First, there is no witness to prove the yellow truck actually stopped. They may just be saying this to avoid fault (I have handled claims where BOTH vehicles claimed they stopped before impact). Second, even if they did stop, the damage was already done. The yellow truck had already backed into the aisle while another vehicle was backing. The yellow truck had already put themselves in the path of the red truck. Therefore, liability should remain at 50/50.

In cases like this, insurance companies will often settle at 50% on each driver. Both drivers were backing at the same time, the damage is done. If the two insurance companies do disagree, arbitration usually leans toward 50/50, unless there is independent proof, like a witness statement.

Parking Lot Specifics

I want to touch on a few specific things to know about parking lots:

First, parking lots and parking garages are usually private property, not public highways. Technically, most traffic statutes don’t apply in a parking lot. For instance, speed limit and stop signs are usually put up by the property owner, not placed by the local government. So police won’t ticket drivers for running the stop sign. In fact, police usually won’t respond to an accident in a parking lot unless there are serious injuries involved.

However, insurance companies will absolutely apply the rules of the road to parking lots. It’s a necessity. If you can’t apply those rules, what rules would you apply? Parking lots would devolve into lawless territories (even more than they already are).

Second, pedestrians will almost always have the right of way. It doesn’t matter if you’re driving forward, reverse, or sideways (if you have the new Hummer with crabwalk mode). As a driver, you need to keep your head on a swivel. Always be on the lookout for people of all sizes (think of the children)!

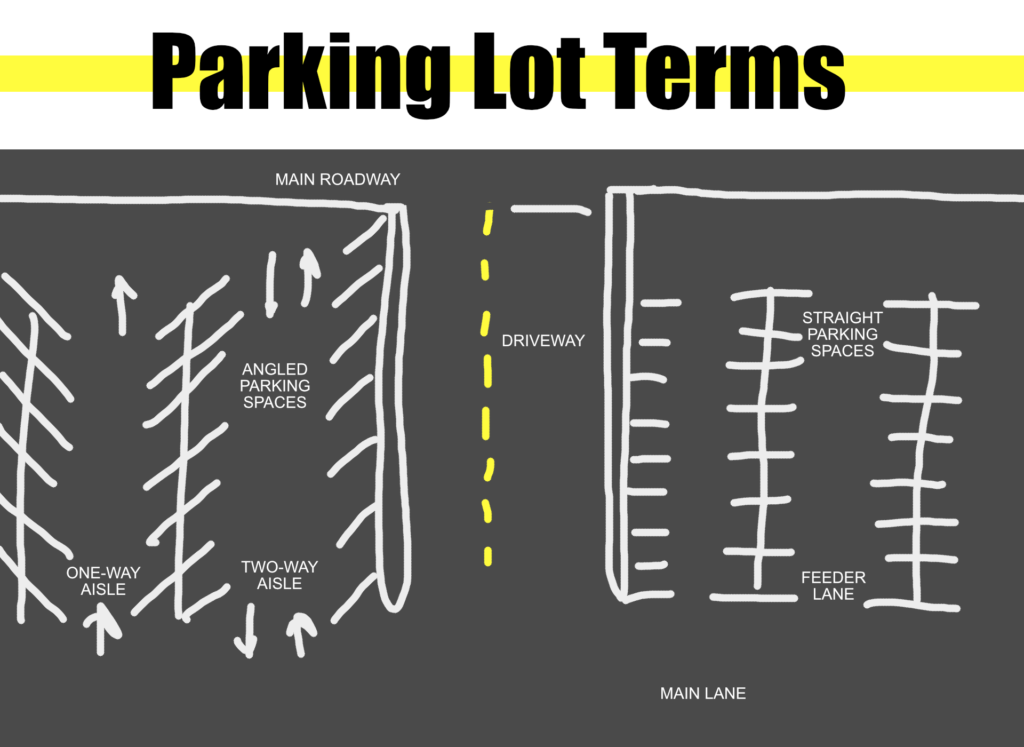

Third, insurance adjusters will use specific terminology for parking lots. Be prepared to specify if the lot had one- or two-way aisles, a main lane vs feeder lanes, straight-in or angled parking spaces. Adjusters will also ask how crowded the parking lot was at the time of the accident, whether there were specific cars blocking vision, or pedestrians in the vicinity.

Alternate Scenarios

I’ve handled some weird parking lot accidents. Each one is unique, and each new claim presents the possibility of a new situation. Here are some variations:

I’ve handled multiple claims where the driver simply mixed up the gas pedal and the brake pedal. Or drive and reverse. Simple driver error like this is more common than you think.

In this example, the pink car hits a parked vehicle, gets flustered, and accelerates into another parked car. But just as likely, the car may hit a building, a light pole, or any other object. When a car drives into a fixed object, whether forward or reverse, the driver would be at fault.

This is also great time to interject: if a car is parked illegally, that doesn’t mean it’s okay to hit them. In this example, the green car is parked in a yellow zone in front of a fire hydrant. The yellow truck may argue they shouldn’t be at fault because the green car shouldn’t have been there.

However, the green car is clearly there to be seen. A parked car is functionally a fixed object. The yellow truck is still 100% at fault for backing into them.

Here we will get a bit more complicated. In this example, the blue car is traveling forward in the aisle, but going the wrong way in a one-way aisle. The red truck is backing from a parking spot. They only look in the direction they expect traffic to come from, which is clear. But they don’t see the blue car coming from the other side.

A case like this is where we get to consider all the factors. The red truck is negligent due to unsafe backing. But the blue car is also negligent by going the wrong way.

Neither vehicle actually has a right of way (a legal right to continue their path). But we can say the blue car has control of the aisle. The red truck might argue that they couldn’t have anticipated a vehicle coming that direction. But remember, they still have a duty to look that way. There could easily be a pedestrian walking there.

Different adjusters may come to varying opinions on this, but the majority of fault would be on the backing vehicle. Personally, I would assess about 75% on the truck, and 25% on the blue car. Exact percentages might depend on factors like danger recognition and evasive action.

The point of impact makes a difference, too. In this example, the driver side rear corner of the truck hits mid-driver-side on the car. So the car was obviously there to be seen directly behind them at impact. If they had backed earlier, and maybe the front of the blue car hit the side of the truck, then I would assess more liability on the car, closer to 40%. However, the backing vehicle would still be majority at fault.

One more example. This is an actual claim I handled. I remember it specifically because it is an exception to the rule. Remember, liability is always situational.

This accident happened in a high school parking lot. The green car was a teenager in a 350Z. He was traveling forward, and went from one aisle around to the next. The white van was a minivan, driven by a mother picking up her son. She looked, saw the aisle was clear, and backed out.

Now, when taking statements in parking lot accidents, the backing vehicle will often claim the other car was speeding, driving recklessly, etc. But they rarely have any proof. And when pressed, they admit they didn’t see the other car before impact, so they don’t actually know.

But in this case, the school had a security camera, and we obtained the video. It showed the woman in the minivan started backing when the green car was all the way over in the next aisle. The kid in the car truly whipped around the corner. I was able to compare the frame times on the video to measurements of the parking lot on Google Maps. My calculations showed the car was moving in excess of 25 mph, far faster than a safe speed when rounding a corner in a busy parking lot full of kids after school.

The minivan still had liability, because she was still backing at the time of the collision. However, I put the green car majority at fault (I believe about 70%), due to reckless speed, and failure to yield while making a turn. I argued that the minivan actually had control of the aisle, since they were mostly out of their space and taking up the aisle before the car rounded the corner.

Why Do These Accidents Happen?

Setting aside the possibility of a driver just hitting the wrong pedal, most backing accidents boil down to a driver not seeing the other car.

There are several reasons for this.

- Driver doesn’t know their sightlines and blind spots.

- Driver is distracted.

- Driver simply doesn’t look.

How To Avoid Backing Accidents

Know your sightlines and blind spots. They say practice makes perfect. Well, perfect may be out of human reach, but practice certainly helps. You need to know what you can and can’t see when backing. If you know you have a blind spot, you can compensate for it.

I would recommend sitting in your driver’s seat as if you are backing, and have someone walk around behind your car. Have them go slowly, and tell them to stop if they leave your sightline.

Knowing where they are, find a way to compensate for that blind spot. Try leaning forward to get a different angle on your mirrors. Try adjusting your rear view mirror. Check your backup camera, if you have one. Also check the sensitivity of reverse sensors if you have them.

Avoid distractions. Many people consider parking lots less serious than driving on a road. In a poll by the National Safety Council, 66% of drivers said they would make a call while driving in a parking lot. And 49% even said they would take photos or watch videos while driving in a parking lot. That’s terrifying.

Again, don’t just look for a large vehicle. Consider that a small child could easily be walking down that aisle. When you’re driving, you’re driving.

Make sure you look. You might be in a hurry to get home, especially after a long day of work, or lugging your kids through the grocery store. But don’t just throw it in “R” and get out of there.

Remember that backing is one of the most dangerous things you will do in a car. Look and keep looking. Just because you get halfway out of your spot doesn’t guarantee you can finish backing safely. Pay attention to your peripheral vision. Back at a safe speed, which will give you enough time to stop if you see danger.

Consider backing into the space when you park. When you are arriving at your destination, you have a more broad, clear vision of the area. You can see the entire parking space as you drive by it, ensuring it is empty. You know you have control of the aisle, and you can back in more safely.

When you go to leave, you are now facing forward. You should have an unobstructed view of your path, and you are much less likely to drive into someone.

Don’t back any further than you need to. That’s what my dad always told me when I was learning to drive, and the advice still holds up. Backing up is inherently more dangerous than driving forward, so minimize the distance you travel in reverse. Back up just enough to leave your space, and safely pull forward.

A Note On Driver’s Aids and Safety Features

Modern vehicles are available with a wide range of safety features. These include back up cameras and reverse sensors.

It’s nice to know you have these features to help you. But technology does not relieve the driver from responsibility.

I’m sorry to say, these features may not always work in every situation. Your camera’s field of view might not be wide enough to see a car coming down the aisle. Your sensor alarms might not sound in time for you to stop.

If your safety features fail, you are still responsible for any unsafe movement of your vehicle. “My sensor didn’t go off” does not change liability.

What To Expect If You Are Involved

At-Fault Driver

If you are a negligent driver in a backing accident, you will need to talk to your insurance company to have the accident covered. They will open a liability claim to handle any damages you are legally responsible for. Once they have fully investigated and determined liability, they will handle the other party’s damages, up to your policy limits.

If you have collision coverage on your vehicle, they will handle the cost of repairs, minus your deductible. If your car is a total loss, they pay the cash value of your vehicle, minus your deductible. And if you have rental coverage, they will provide you with a rental according to your coverage amounts and policy limits.

If you are injured, even in a parking lot accident, you will be able to use whatever first-party coverages you have available. Depending on your state, this can include Personal Injury Protection (PIP), or Medical Payments Coverage (MedPay). If you do not have medical coverage through your car insurance, then you will need to use whatever health insurance you have available.

Not-At-Fault Drivers

If someone else is at fault for your accident, in most states you have the option of using your own insurance or the at-fault insurance company to handle your vehicle damage.

If you go through your own insurance company, you will use whatever collision and rental coverages you have available. You will be responsible for your deductible. Some insurance companies have options to cover your deductible if the other company agrees on liability. You will need to ask your insurance carrier about their options.

Your insurance will cover your damage, then pursue the at-fault company is a process known as subrogation. The at-fault party’s insurance owes for the damage caused, so they will need to pay your company back, including any deductible.

You would also have the option of pursuing your claim directly with the at-fault company. You are owed fair compensation for your property damage, which can include payment for repairs or the value of your vehicle, a rental car covered for a reasonable time period, and reimbursement for any other items damaged in the collision. Additionally, some states allow for diminished value claims, but those claims tend to be limited to very new vehicles.

Shared Liability

Backing accidents have a high probability of shared liability. Each state has their own way of handling comparative negligence. In some states, each party owes the other for their percentage of fault. In some states you are barred form recovery (receiving any payment) if you are over 49% or 50% at fault. And in some you are barred from recovery if you share any amount of fault.

Your best option in cases of shared liability will depend on what kind of coverage you carry. If you carry collision coverage on your car, I would recommend going through your own policy. They will be able to cover 100% of your damage, then recover what they can from the other company.

If you have a liability-only policy, you may be forced to pursue a claim through the other company. But if the other driver was only 50% at fault, they will only pay for 50% of your damage. You will need to pay the rest of your repairs out of pocket.

Injury Claims

Most backing accidents are at low speeds, and don’t result in injuries. However, injuries are always a possibility. It doesn’t take that much force to tweak someone’s neck, especially if they are twisting their head at an angle.

And then there’s the possibility of hitting a pedestrian. One of the first pedestrian claims I handled was a very low-speed parking lot accident. Our insured driver was backing out slowly, and bumped a lady she didn’t see. The lady fell, tried to catch herself, and broke her wrist. That’s a major claim from a 2 mph accident.

If you have been injured in a backing accident, you first need to think about getting proper medical attention. Get checked out, and follow your doctor’s medical advice regarding treatment.

You need to know where your medical expenses get paid. Your bills will initially be covered by your first-party coverage. Depending on your state, this can include PIP or Medpay. If you do not have medical coverage on your auto policy, or if those limits are paid out, then your personal health insurance is next in line. Last in line to pay is Medicare, Medicaid, or any other government-provided insurance.

Separate from normal coverage of your medical bills, you may have a bodily injury liability claim with the at-fault company. Fair compensation for your injuries includes both economic and non-economic damages.

Economic damages are the solid numbers. This can include medical bills, ambulance bills, prescription drug costs, and lost wages due to your injuries. If these costs have been covered by your insurance, then part of your settlement will reimburse them.

Non-economic damages are intangible items. This is often called general damages, or pain and suffering. Typical financial compensation varies widely depending on the details of your case, including diagnosed injuries, treatment provided, impact on your personal life, venue (the location of your case), and many other potential factors. Each injury case is as unique as the person who was hurt.

Injury liability claims are always paid in the form of a settlement. This is a one-time payment inclusive of all items related to your injuries. You will typically need to sign a release before any payment is made by the at-fault company. Do note that injuries are handled separately from property damage. You can have them pay for your vehicle without settling your injury claim.

Do I Need A Lawyer?

As a former adjuster, I cannot and do not give legal advice. I cannot tell you what your claim is worth or if you need legal counsel. An injury settlement is an agreement between you and the at-fault insurance company. Those two parties are the only ones who can finalize an agreed settlement amount.

However, I can tell you that you are not required to have an attorney handle your injury claim. I have settled countless injury claims directly with the injured party. Your role as a claimant in a personal injury claim is to provide proof of injury, most often in the form of medical records. But even with that, the insurance companies will usually be of help. It is standard practice for the injury adjuster to offer a medical authorization, which lets them collect the records for you. If you are someone who wants to handle your claim on your own, you can in most cases. I plan to provide more detailed information on injury handling in the future, which I will link here.

If you do feel you need legal representation, or just to review your options, you can contact a personal injury attorney in your area. An experienced car accident lawyer may be able to give you more detailed information about the specific laws and processes in your state, as well as their opinion of the value of your claim. Personal injury lawyers will often give a free consultation to discuss the major facts of your case and advise you of your legal rights. If you do want to consult an attorney, I would recommend finding someone local, as they will know your area better than a large chain or out-of-state firm.

Explore more accident types here.

0 Comments